Last Updated on Ocak 3, 2026 by Ideal Editor

🏘️ Property in Turkey 2026: A Look at the Year Ahead

Turkey’s real estate market enters 2026 at a defining crossroads. After a prolonged period marked by inflationary pressure, currency volatility, tightened monetary policy, and regulatory restructuring, the sector is moving into a phase of recalibration and renewed opportunity. Property In Turkey 2026 for both domestic buyers and international investors, 2026 represents a year of strategic positioning rather than speculative momentum.

Turkey remains one of the few markets globally where lifestyle appeal, demographic growth, and investment incentives intersect at scale. A young population, expanding urban centres, strong tourism inflows, and sustained foreign interest continue to underpin demand. At the same time, regulatory reforms introduced over recent years are maturing, resulting in a more transparent and predictable environment for property ownership.

This extensive, forward-looking guide explores the Turkish property market in 2026 in depth. It covers national and regional sales forecasts, pricing outlooks, rental trends, legal and tax developments, foreign investment dynamics, and the specific opportunities in Antalya and Alanya. The content is tailored for international buyers, long-term investors, and lifestyle purchasers seeking authoritative, actionable insights.

📊 Turkey Real Estate Market Overview 2026

The Turkish property market is shaped by three fundamental forces:

🏗️ Structural demand driven by population growth, urbanisation, and household formation

💰 Macroeconomic cycles influenced by interest rates, inflation, and currency movements

📜 Regulatory evolution aimed at market stability, compliance, and long-term sustainability

By 2026, Turkey is expected to benefit from a more balanced macroeconomic backdrop. Inflation is forecast to gradually ease, interest rates are expected to trend downward from recent highs, and consumer confidence is anticipated to strengthen. These conditions collectively support improved affordability, increased transaction volumes, and renewed investment confidence.

Key national trends shaping 2026 include:

• Gradual recovery in total transaction volumes • Increased preference for new-build, energy-efficient housing • Continued dominance of cash buyers, especially among foreign purchasers • Rising rental demand in metropolitan and coastal cities • Strong appetite for off-plan and pre-completion investments

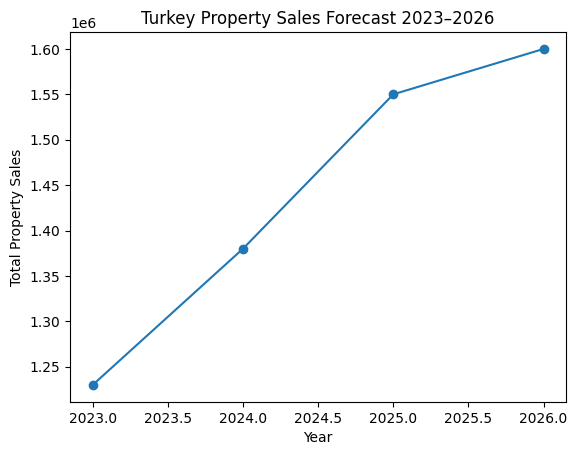

📈 National Property Sales Forecasts

🕰️ Historical Context

Turkey typically records between 1.2 and 1.6 million residential property transactions per year. Sales volumes declined during periods of restrictive monetary policy, particularly when mortgage interest rates reached historic highs. However, 2024 and 2025 marked a turning point, with a clear rebound in overall activity driven by pent-up demand and increased cash transactions.

🔮 2026 Sales Outlook

For 2026, market expectations indicate:

• Annual property sales exceeding 1.5 million units • Improved participation from mortgage-backed buyers • Stronger performance in coastal and metropolitan regions • Continued resilience in the second-hand market

📋 Sales Breakdown Forecast

| Segment | Share of Total Sales | 2026 Trend |

|---|---|---|

| First-hand (new build) | 30–35% | Increasing |

| Second-hand | 65–70% | Stable |

| Domestic buyers | 94–95% | Stable |

| Foreign buyers | 5–6% | Gradual recovery |

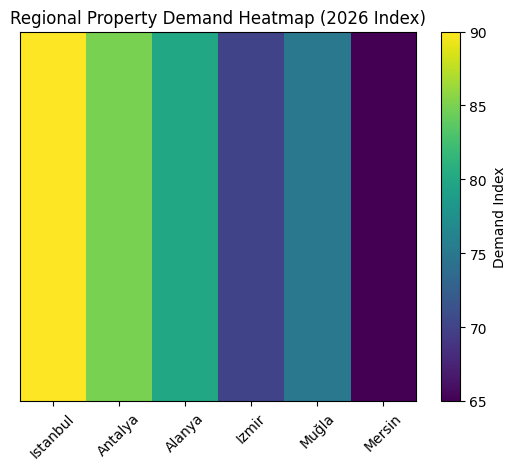

🗺️ Regional Property Market Analysis

🏙️ Istanbul

Istanbul remains Turkey’s largest, most liquid, and most diverse property market. It functions simultaneously as the country’s economic engine, cultural centre, and primary destination for institutional and high-net-worth investment.

Key characteristics for 2026:

• Strong demand in centrally located, transport-oriented districts • Ongoing urban regeneration and earthquake-resilience projects • Consistent rental demand from students, professionals, and migrants • Stable yields in well-located, modern developments

High-demand districts include Kadıköy, Ataşehir, Kağıthane, and Başakşehir. Istanbul continues to attract investors focused on long-term capital appreciation, portfolio diversification, and rental income stability.

🌴 Antalya – Strategic Focus Market

Antalya stands out as one of Turkey’s most important property markets in 2026, particularly for foreign buyers and lifestyle investors.

⭐ Why Antalya Leads

• International tourism hub with year-round flight connectivity • Strong infrastructure, healthcare, and education facilities • Large and established foreign resident population • Excellent short-term and long-term rental performance

🏗️ Key Investment Districts in Antalya

• Altıntaş: Airport-adjacent, new-build hotspot with strong capital growth potential • Konyaaltı: Premium coastal living, limited land supply, high demand • Lara: Luxury residential area with strong holiday rental appeal • Kepez: Affordable entry point with long-term urban growth prospects

Antalya is expected to record steady price appreciation in 2026, supported by tourism, foreign demand, and ongoing infrastructure investment.

🌊 Alanya – Lifestyle and Value Opportunity

Alanya remains one of Turkey’s most internationally recognised coastal property destinations. It appeals strongly to lifestyle buyers, retirees, and investors seeking value and rental potential.

Market characteristics:

• Strong appeal to European, Russian, and Eurasian buyers • Lower average entry prices compared to other Mediterranean resorts • High proportion of lifestyle-driven purchases • Well-developed rental market supported by tourism

📍 Key Neighbourhoods

- Mahmutlar: High-density, affordable investment zone

- Oba: Family-oriented district with balanced lifestyle appeal

- Kargıcak: Low-density luxury villas and panoramic sea views

Although foreign sales volumes fluctuated in recent years, Alanya’s long-term fundamentals remain strong, particularly for buyers prioritising affordability, climate, and community.

🧭 Other Notable Regions

- Izmir: Lifestyle-focused demand and strong domestic buyer base

- Muğla (Bodrum, Fethiye): Premium second-home and luxury segment

- Mersin: Emerging coastal market with infrastructure-driven growth

💸 Property Price Forecasts for 2026

📈 National Price Trends

Price growth in 2026 is expected to be more measured compared to inflation-driven surges seen in previous years. The market is transitioning toward sustainable appreciation aligned with real demand.

Forecast averages:

• Nominal price growth: 15–25% • Real (inflation-adjusted) growth: 5–10%

🏠 Price Growth by Segment

| Property Type | Expected Growth |

| New-build apartments | 18–25% |

| Resale apartments | 12–18% |

| Villas | 20–30% |

| Land plots | 25–40% |

🔑 Rental Market Outlook

• Rising demand from students, professionals, and expats • Strong short-term rental yields in tourist cities • Continued supply constraints supporting rent growth

⚖️ Legal, Tax, and Regulatory Changes in 2026

🛂 Citizenship by Investment

• Minimum qualifying property investment remains USD 400,000 • Mandatory three-year holding period • Enhanced valuation and compliance checks

🏡 Residence Permits

• Higher minimum property value thresholds in key areas • Some districts restricted for new foreign residency registrations

🧾 Property Taxes

• Annual property tax remains low by international standards • New caps introduced to prevent excessive annual valuation increases

🏖️ Short-Term Rental Regulations

• Mandatory licensing and registration • Increased enforcement and fines for non-compliance

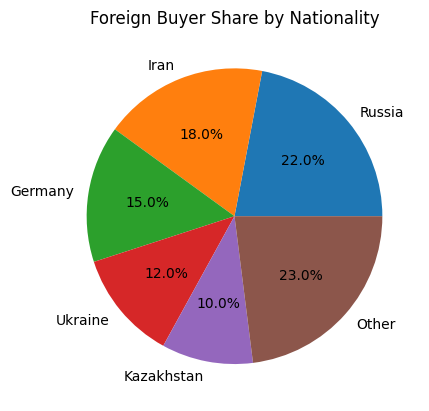

🌐 Foreign Investment Opportunities in 2026

👥 Key Buyer Profiles

• Lifestyle buyers from Europe • Investors from the Middle East and Central Asia • Digital nomads and remote professionals

🚀 High-Potential Investment Themes

• Off-plan developments in growth districts • Branded residences and managed rental projects • Mixed-use developments near transport hubs

⭐ Why Invest in Turkish Property

🇹🇷 Reasons for Local Buyers

• Property as a hedge against inflation • Cultural preference for real estate ownership • Strong and growing rental demand

🌍 Reasons for Foreign Buyers

• Competitive pricing versus Europe • Mediterranean lifestyle and climate • Residency and citizenship pathways • Attractive rental yields in tourist regions

Special attention areas:

• Antalya: Balanced lifestyle and returns

• Alanya: Value, affordability, and community appeal

🤝 How Ideal Estates Supports Buyers

Ideal Estates delivers comprehensive, end-to-end property solutions for international and domestic clients.

🛠️ Services Include

• Market research and investment strategy • Property sourcing and due diligence • Legal coordination and compliance • Residency and citizenship assistance • After-sales services and property management

🏆 Why Partner with Ideal Estates

• Local expertise with international standards • Transparent, client-first approach • Strong presence in Antalya and Alanya • Proven track record with foreign investors

📊 Custom Charts and Infographics (Suggested)

• Turkey Property Sales Forecast 2023–2026 (Line Chart) • Regional Demand Heatmap (Map Graphic) • Foreign Buyer Share by Nationality (Pie Chart) • Antalya vs Alanya Investment Comparison (Visual Table)

❓ Frequently Asked Questions About Property in Turkey 2026

1. Is 2026 a good year to buy property in Turkey?

Yes. Stabilising economic conditions and strong structural demand make 2026 an attractive entry point.

2. Which cities offer the best investment potential?

Antalya, Alanya, Istanbul, and selected Aegean coastal towns.

3. Can foreigners still obtain Turkish citizenship through property?

Yes, subject to minimum investment thresholds and compliance rules.

4. Are rental returns attractive in 2026?

Yes, particularly in tourist destinations and major cities.

5. How can Ideal Estates help international buyers?

Through expert guidance, legal coordination, and direct access to high-quality property opportunities.